24 hour help service

0114808085

the news

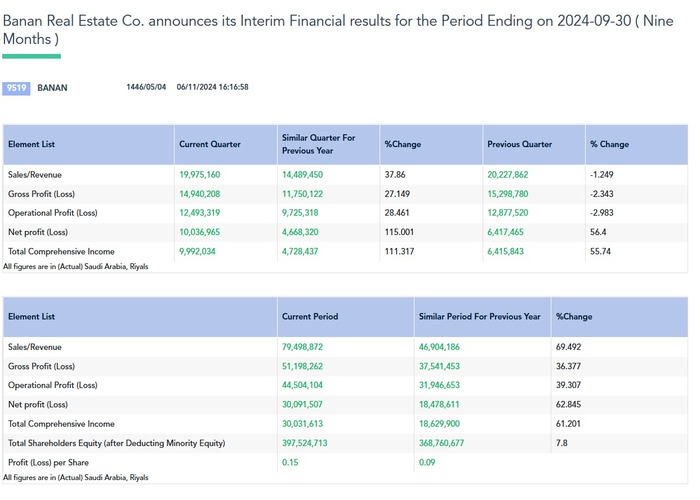

Banan Real Estate Co. announces its Interim Financial results for the Period Ending on 2024-09-30 ( Nine Months )

06/11/2024

| Element List | Current Quarter | Similar quarter for previous year | %Change | Previous Quarter | % Change |

|---|---|---|---|---|---|

| Sales/Revenue | 19,975,160 | 14,489,450 | 37.86 | 20,227,862 | -1.249 |

| Gross Profit (Loss) | 14,940,208 | 11,750,122 | 27.149 | 15,298,780 | -2.343 |

| Operational Profit (Loss) | 12,493,319 | 9,725,318 | 28.461 | 12,877,520 | -2.983 |

| Net profit (Loss) | 10,036,965 | 4,668,320 | 115.001 | 6,417,465 | 56.4 |

| Total Comprehensive Income | 9,992,034 | 4,728,437 | 111.317 | 6,415,843 | 55.74 |

| All figures are in (Actual) Saudi Arabia, Riyals | |||||

| Element List | Current Period | Similar period for previous year | %Change |

|---|---|---|---|

| Sales/Revenue | 79,498,872 | 46,904,186 | 69.492 |

| Gross Profit (Loss) | 51,198,262 | 37,541,453 | 36.377 |

| Operational Profit (Loss) | 44,504,104 | 31,946,653 | 39.307 |

| Net profit (Loss) | 30,091,507 | 18,478,611 | 62.845 |

| Total Comprehensive Income | 30,031,613 | 18,629,900 | 61.201 |

| Total Shareholders Equity (after Deducting Minority Equity) | 397,524,713 | 368,760,677 | 7.8 |

| Profit (Loss) per Share | 0.15 | 0.09 | |

| All figures are in (Actual) Saudi Arabia, Riyals | |||

| Element List | Amount | Percentage of the capital (%) | |

|---|---|---|---|

| Profit (Losses) Resulting From The Change In Investment Propertie’s Fair Value | - | - | |

| All figures are in (Actual) Saudi Arabia, Riyals | |||

| Element List | Explanation |

|---|---|

| The reason of the increase (decrease) in the sales/ revenues during the current quarter compared to the same quarter of the last year is | The reason for the increase in revenues during the current quarter compared to the same quarter of the previous year is due to the increase in real estate rental revenues in addition to the sale of a villa in Al Hada district in the subsidiary company for a value of 2,8 million riyals. |

| The reason of the increase (decrease) in the net profit during the current quarter compared to the same quarter of the last year is | The reason for the increase in net profit during the current quarter compared to the same quarter of the previous year is due to * 1- Increase in revenues by 5,49 million 2- Decrease in Zakat provision by 502 thousand Saudi Riyals 3- Decrease in financing costs by 664,3 thousand Saudi Riyals 3- Reversal of expected credit loss provision by 1,085 million Saudi Riyals compared to the formation of a provision by 751 thousand in the same period 4- Reversal of a decrease in the value of investment properties by 107 thousand compared to a decrease in the same period by 1,213 million Saudi Riyals |

| The reason of the increase (decrease) in the sales/ revenues during the current quarter compared to the previous one is | The reason for the decrease in revenues during the current quarter compared to the previous quarter, despite the increase in rental revenues, is because there was a sale of land in Al-Qadisiyah neighborhood in the previous quarter. |

| The reason of the increase (decrease) in the net profit (loss) during the current quarter compared to the previous one is | The reason for the increase in net profit during the current quarter compared to the previous quarter is due to 1- A decrease in financing costs of 193 thousand riyals 2- There is a loss provision in the previous quarter amounting to 1,155 million riyals and the current quarter has a reversal of the provision amounting to 1,08 million riyals 3- There is a profit realized from the sale of assets at fair value amounting to 158 thousand riyals 4- The change in the fair value of financial assets during the current quarter 659 thousand riyals |

| The reason of the increase (decrease) in the sales/ revenues during the current period compared to the same period of the last year is | The reason for the increase in revenues during the current period compared to the same period of the previous year is due to an increase in real estate rental revenues by 5,8 million Saudi riyals and an increase in revenues from the sale of lands in Al-Qadisiyah neighborhood by 26,3 million. |

| The reason of the increase (decrease) in the net profit during the current period compared to the same period of the last year is | The increase in net profit during the current period compared to the same period of the previous year is due to an increase in rental revenues, profit from the sale of land and a decrease in financing costs by 1,09 million riyals. |

| Statement of the type of external auditor's report | Unmodified conclusion |

| Comment mentioned in the external auditor’s report, mentioned in any of the following paragraphs (other matter, conservation, notice, disclaimer of opinion, or adverse opinion) | none |

| Reclassification of Comparison Items | none |

| Additional Information | - |